Introduction

As promised, we now began to explore the process behind financial decisions. In the previous module, we looked back at historical data to gain knowledge of the past behavior of a time series as well as seek relationships between two data sets. Now, using the same historical data, we will begin to court the concept of prediction: what if we look at the start of a historical time series up an intermediate point of time and pretend we do not know the rest of it — as if we had travelled back in time and also had amnesia. Such thought exercise puts us at a position where we can try to make a prediction of what might happen next, given our observations of what has happened until now, then make a decision to either take action or wait, and (this is the cool part) finally study the outcome of our decision by looking at the "future data" that comes after the intermediate point of time to which we chose to "travel back".

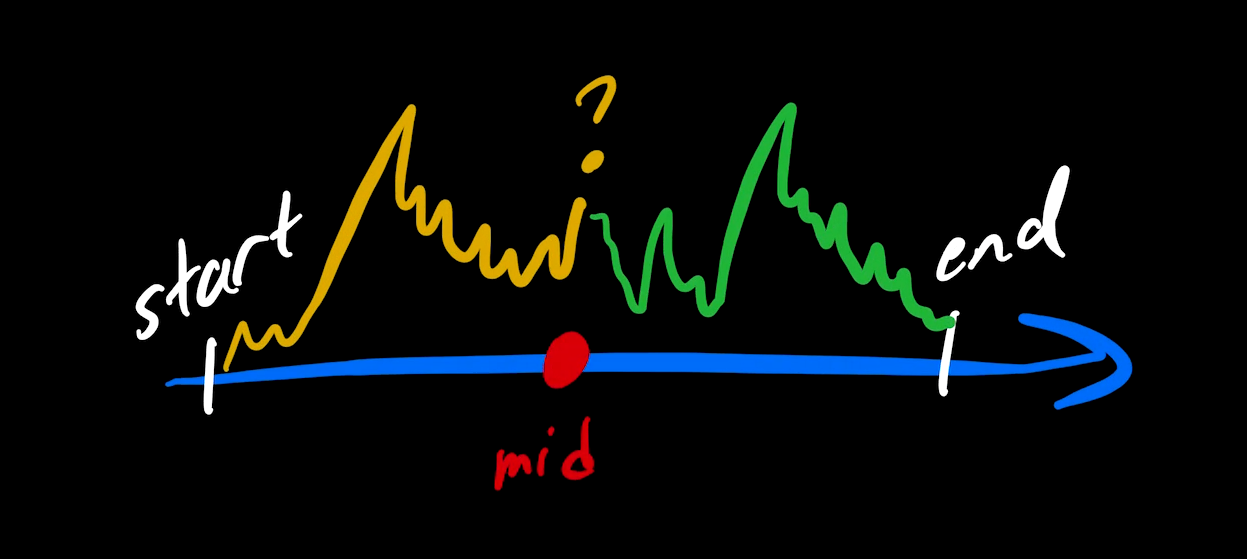

In the illustration above, the left-hand side is the earlier data that we are allowed to analyze. The right-hand side is the data we pretend not to have. We make predictions and/or take action based on our analysis at the cut-off point. Then we let "time advance" by looking at that previously ignored later data to assess what would have happened: was our prediction precise, did we choose our actions (or lack thereof) appropriately in terms of the resulting outcome?

Learning outcomes

This module will help you do the following:

- identify trends and patterns in time series

- emulate historical data as a basis for decision making

- observe the impacts of decision in light of future data

Warm-up

Ryan Furhmann. When to Buy a Stock and When to Sell a Stock: 5 Tips. July 26, 2022.

Warm-up assessment

One is supposed to buy stocks when prices are low and then sell when they reach a high. When all you have is a fragment of historical data, let's say the past 60 days, what would you do to try to determine whether the price is about to go lower, higher, or stay roughly stable? Elaborate briefly on what to look for and how to quantify it, in terms of your existing knowledge.

Concepts

After this module, you should be familiar with the following concepts:

- Transaction

- Decision making

- Trend

- Prediction

- Data collection

Remember that you can always look concepts up in the glossary. Should anything be missing or insufficient, please report it.